DetectiveReports | Crackdown TON 2024 Roadmap

TOC

Introduction

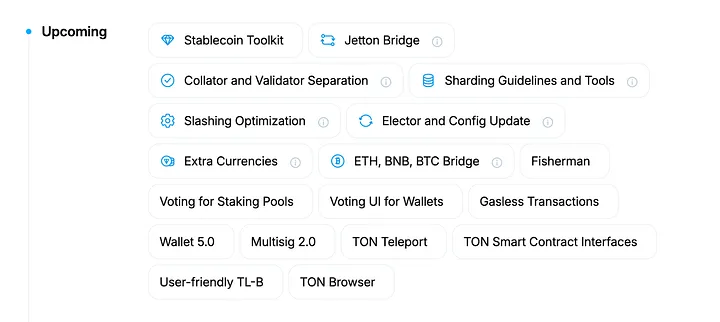

The TON development roadmap is packed with exciting features slated for release in the near future. While no specific dates have been announced, the TON community is eagerly anticipating the launch of the stablecoin toolkit, sharding tools, and native bridges for BTC, ETH, and BNB in 2024. This article will delve into these upcoming features, their potential impact on the network, and whether they will influence TON staking rewards.

From EOS to Solana, almost every cycle sees a public chain said itself will be the origin of “mass adoption”. Will TON take up the mantle of mass adoption in this cycle?

Today, DetectiveTON will be providing a simple analysis of TON's latest Roadmap. Let's get started!

Gasless Transactions: A Game-Changer

One of the most intriguing milestones on the TON roadmap for 2024 is the introduction of gasless transactions. While gasless transactions are not a new invention, account abstraction at the chain level and gaslessness are crucial for onboarding 800 million Telegram users to the TON blockchain.

Gas fees are typically necessary to prevent network spam, but it also prevent the onboading of Web 2 new users. While TON may subsidize these fees in certain cases, such as Telegram wallet or USDT transfers, we believed this will encourage everyday use. Imagine being able to send a friend $5 via Telegram without needing their credit card number or wallet address—and doing so for free.

With the release of the Wallet V5 contract, the desktop version of Tonkeeper Pro has gradually started to offer gasless transaction features. Looking at the current product, Tonkeeper seems more inclined to adopt a "freemium" model, offering blockchain in a "premium" manner.

Staking Updates

Collator and Validator Separation

To accommodate the anticipated onboarding of 500 million Telegram users by 2028, TON plans to implement sharding for improved scalability. Sharding splits the blockchain into multiple shard chains, with each chain having its own subset of validators to collate and validate blocks. However, frequent validator rotations would require them to store the state of all shards, which becomes impractical as the network grows.

TON's solution is to separate validation and collation roles. Collators will store the state of their specific shard chain and collate blocks, while validators will validate and sign blocks for their assigned shard chain. This division of labor allows TON to scale to billions of users. While the official docs don't mention staking rewards, both collators and validators should receive rewards for their contributions.

In the future, when TON will process many thousands transactions per second and server hundred millions or billions of people, no single server would be able to keep actual state of whole network. Fortunately, TON was designed with such loads in mind and supports sharding both throughput and state update.

Sharding Guidelines and Tools

As one of the first blockchains to efficiently leverage sharding, TON will provide essential toolsets and documentation to help centralized exchanges, payment systems, and TON services implement sharding support.

Slashing Optimization

TON currently uses a complaint mechanism to penalize misbehaving validators. Slashing optimization will introduce a better system for detecting and punishing poor validator performance, enhancing TON's robustness. From Detecitve‘view, slashing is a mechanism that urgently needs to be introduced to TON. Currently, TON network market is in a state of congestion, mainly due to some nodes using out-of-date configurations. Based on it, TON Foundation has lanuched a new verison of vaildator software to improve onchain performance.

Initially, liquid staking protocols won't be affected by validator slashing, ensuring users' rewards. Later, slashing will be distributed across TON provided by liquid staking protocols, slightly reducing average APY.

DeFi Enhancements

TON Stablecoin Toolkit

Stablecoin Toolkit may allow anyone to issue algorithmic stablecoins pegged to local fiat currencies, such as GBP, EUR, and others. Given TON’s integration into Telegram, its built-in wallet, and the recent decision to share advertisement profits with channel owners in TON, it’s plausible that Telegram might introduce payments in local stablecoins for its built-in services.

Jetton Bridge

TON already has bridges to Ethereum and BNB chains, allowing $TON and popular coins like ETH, BNB, and USDC to be bridged.

Jetton Bridge will enable users to send TON tokens to other chains. So, more native TON eco tokens could be list on Uniswap.

Extra Currencies

Extra currencies, on the other hand, will enable TON users to create tokens that function similarly to native tokens, which will also be stored in user accounts. The most notable distinction between extra currencies and Jettons is that transactions involving extra currencies are expected to be 2-3 times cheaper since they will not require contract calls. Want to buy BTC, ETH, or other stablecoin? TON will have them all in one place.

Conclusion

TON 2024 roadmap promises a range of new tools to increase TON's popularity and usability. The most impactful updates include native currencies, bridges, and the stablecoin toolkit, which will expand TON's use cases for everyday payments and attract new users. Imagining the potential of combining Telegram with mainstream dApps is truly exciting.

Mini-programs provide a toolkit for community development and user engagement. The integration within Telegram interface makes building and managing communities easier than before. Especially, users who are already familiar with Telegram can easily onboard, significantly reducing costs and making it a cost-effective growth strategy.

Telegram boasts a global user base of 800 million, the most crypto-friendly audience, far surpassing MetaMask wallet's 30 million users. This combination could lead to an explosive adoption scenario, possibly the most likely mass adoption event for crypto world.

Finally, it seems that TON & Telegram are green with envy at the tremendous success WeChat and QQ have achieved in China. They are trying to build a decentralized business empire. However, from Detective's perspective, this is still a long and challenging road ahead. What TON should do now is to open its arms wider to better embrace developers from the East.