"Swap" upon a Hill: Which is the best DEX on TON?

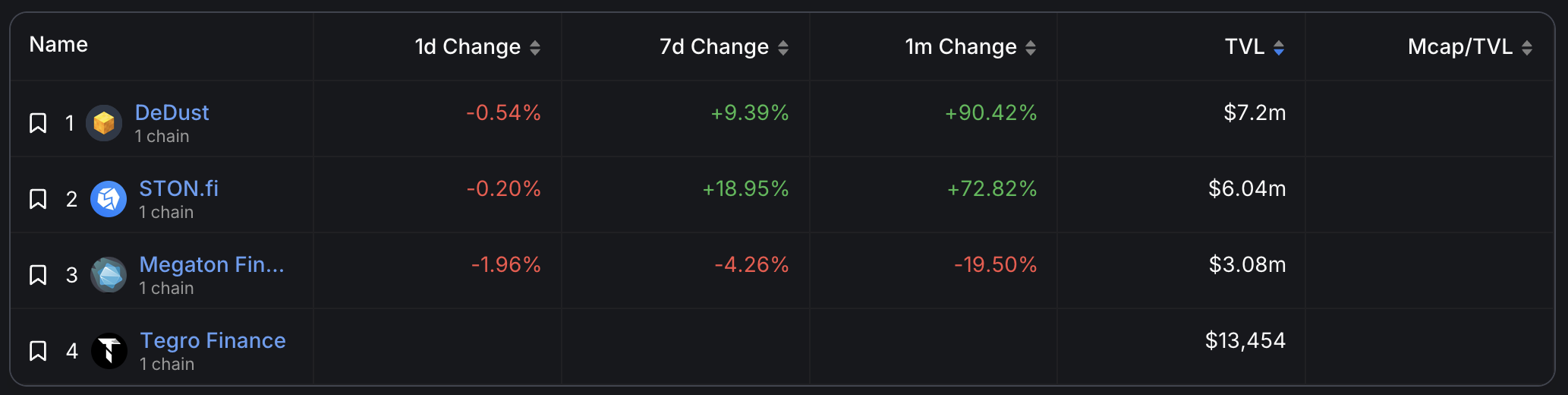

DEX is one of the most crucial infrastructures in a chain's ecosystem. In this article, DetectiveTON is going to introduce the DEX on TON. Currently, TON has three major DEXs (STON.fi, DeDust, MegaTON) and the upcoming PixelSwap.

In this article, we compare the three DEXs from three perspectives: asset richness, trading depth, and trading experience.

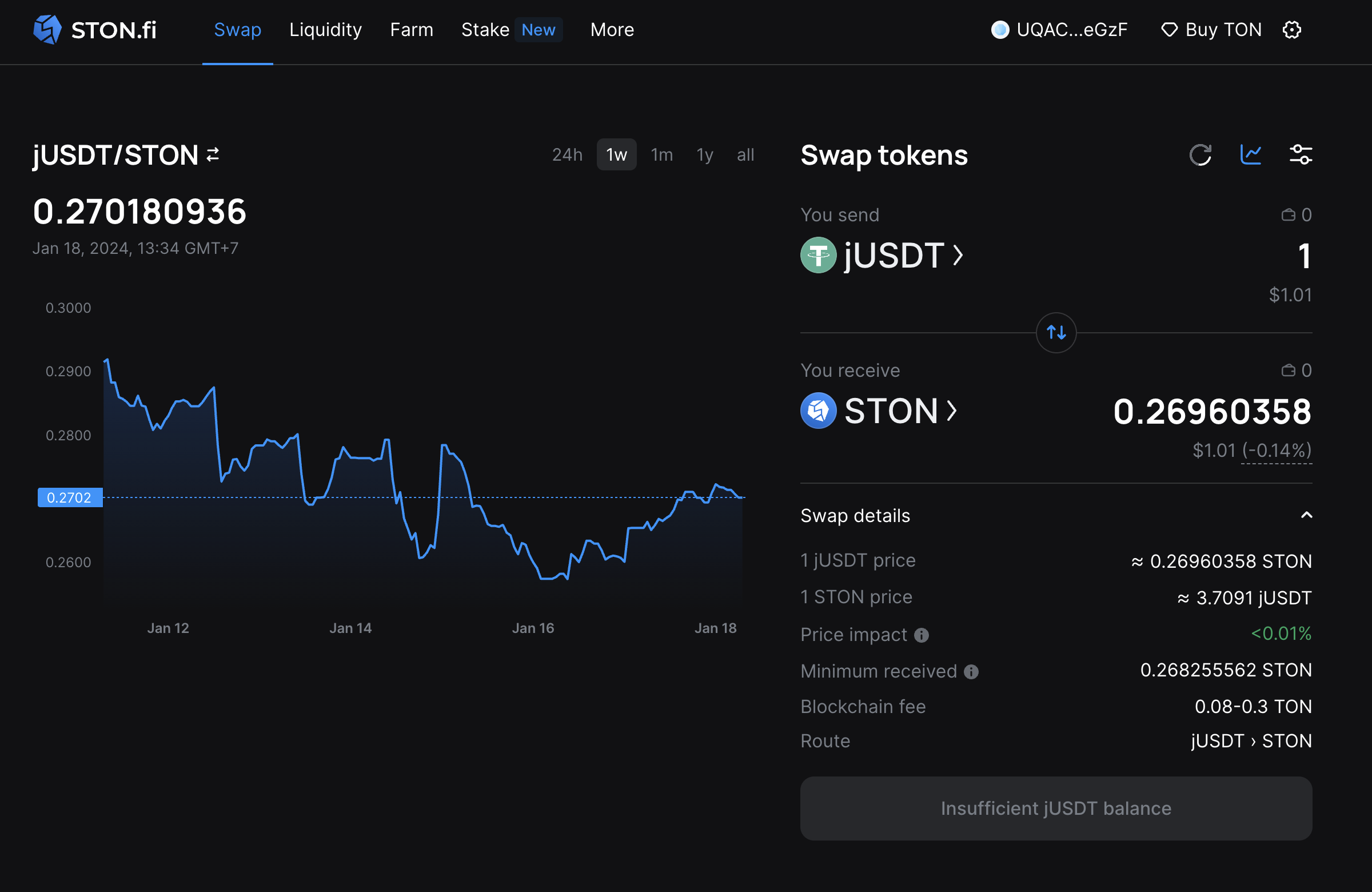

STON.fi

STON is currently the most commonly used and most traded DEX for TON, mainly because STON is Tonkeeper's built-in swap service.

- Assets richness: STON assets are still dominated by large projects of TON Native, such as TonUP, Jetton, TONNEL, etc., and there are relatively few meme tokens.

- Trading depth: Thanks to the advantages of being built into Tonkeeper, most projects will prefer to concentrate their liquidity on STON, and their trading volume will usually be higher than that of DeDust.

- Trading experience: STON will provide historical price charts and will clearly mark price impact, which Detective thinks other DEXs can learn from.

- Fees: STON clearly states in the documentation that swap fees, 0.2% are owned by LPs, and 0.1% are owned by the protocol.

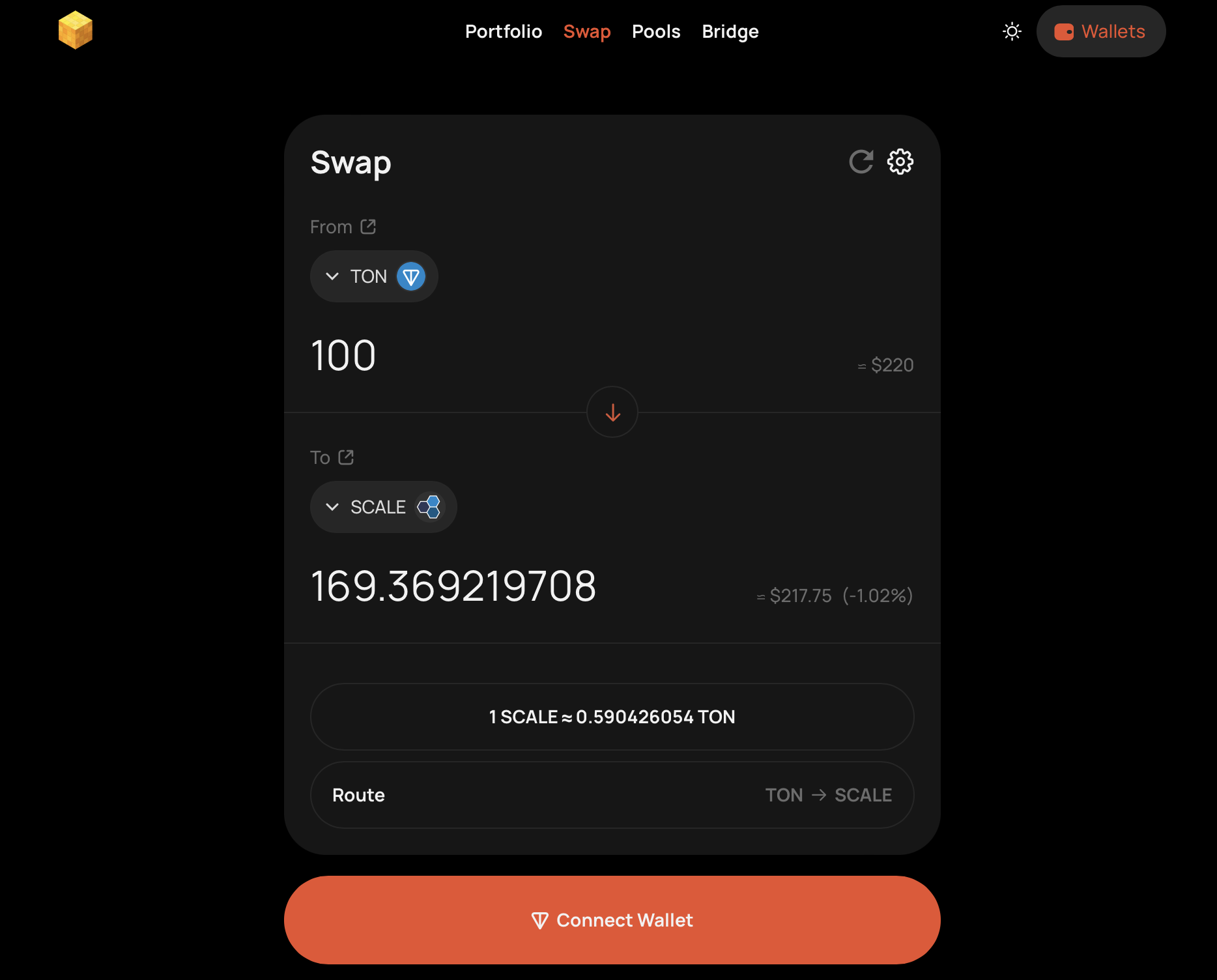

DeDust

DeDust holds the title for the highest TVL among DEXs on TON and offers a remarkably clean and straightforward layout.

- Assets Richness: DeDust is also the preferred liquidity DEX for projects on TON, and unlike STON.fi, a large number of meme coins have chosen DeDust as their main position.

- Trading Depth: Normally, the transaction depth of DeDust will be slightly inferior to STON, but this does not affect DeDust being the DEX with the most meme coins.

- Trading Experience: DeDust offers a unique skill, routing swap. Any two tokens can be swapped through pools with common liquidity. That's why so many community members are loyal to DeDust.

- Fees: DeDust charges a 0.4% transaction fee, of which 80% is paid to liquidity providers and 20% is paid to DeDust's protocol.

MegaTON Finance

Megaton was developed by a Korean team and used to be the DEX with the highest TVL on TON. But with the development of the ecosystem, its experience has lagged far behind other competitors (I don't even want to mention it).

- Assets Richness: Although Megaton seems to support a wide variety of assets, in reality, many tokens are not directly exchangeable.

- Trading Depth: Currently, Megaton's TVL and trading volume are significantly smaller than those of its competitors.

- Trading Experience: Trading bugs that occur from time to time make the Megaton experience unsatisfactory.

- Fees: When exchanging tokens on Megaton Finance's pool, the transaction fee of 0.1% is incurred according to each liquidity pool's fee policy. The transaction fees are paid 100% to LP.

Where is the new competitors?

DEX is one of the most important basic parts of an ecosystem, STON and DeDust have done a good job, but they are obviously not good enough compared to other ecosystems.

We're also excited to see more competitors emerge, including ION finance, which focuses on orderbooks, and PixelSwap, which offers weighed pools.

DetectiveTON would love to see more and better products on TON, as DEXs are the foundation of any ecosystem thriving. Lastly, DetectiveTON once again calls on all DeFi on TON to pay better attention to open source and code security. Building a truly decentralized and secure product is at the heart of DeFi.