APY? APR? How your interest is calculated?

There are more and more DeFi opportunities on TON, whether it's liquidity mining on DEX or single coin pledges like TonUP Launchpool, all of them involve a yield calculation. Many readers have been surprised to find that the yields listed on the official website are quite different from the actual yields in hand, and this is usually due to the fact that the website generally uses APY not APR, which is a way of calculating compound interest. Today, DetectiveTON is going to give a brief about the tricks behind it.

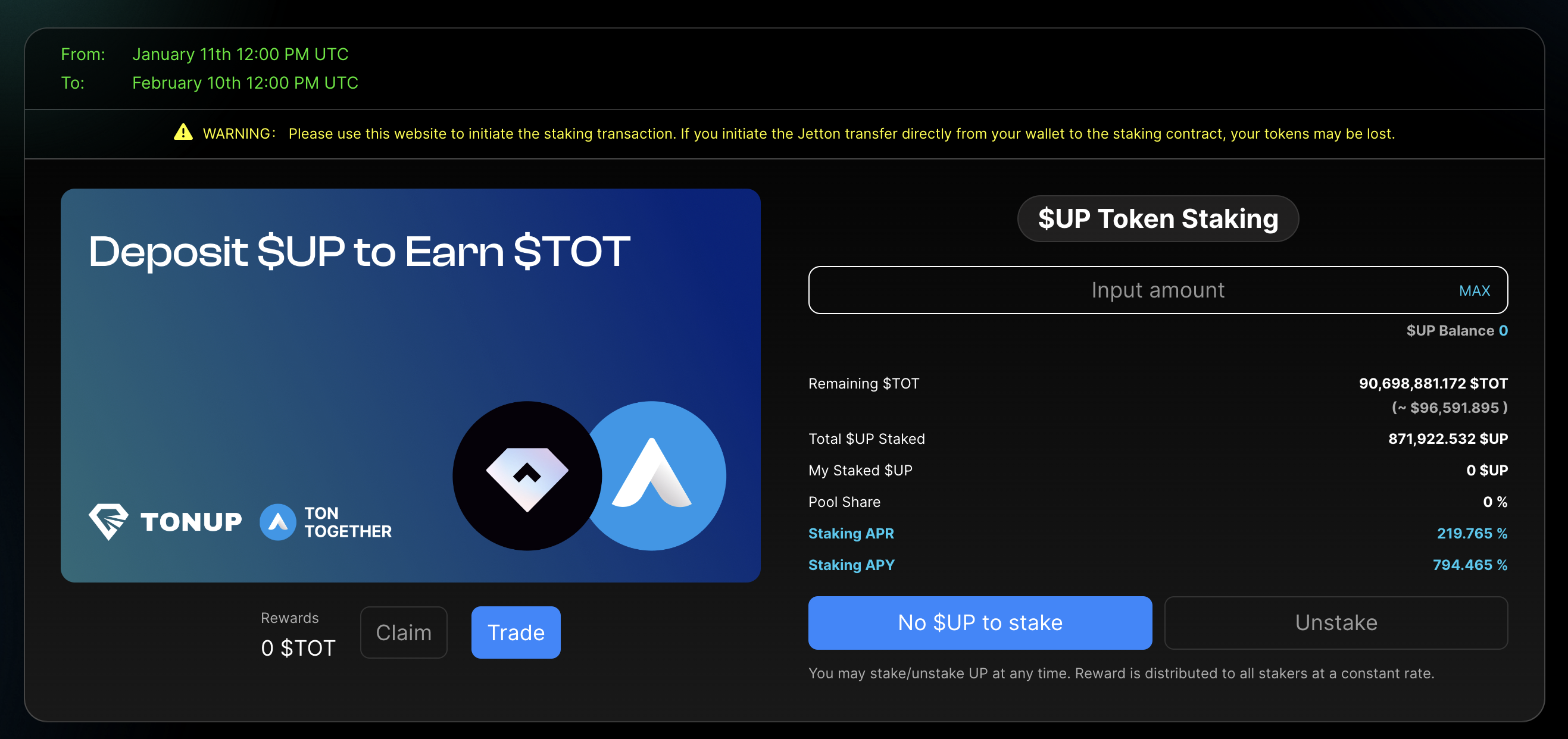

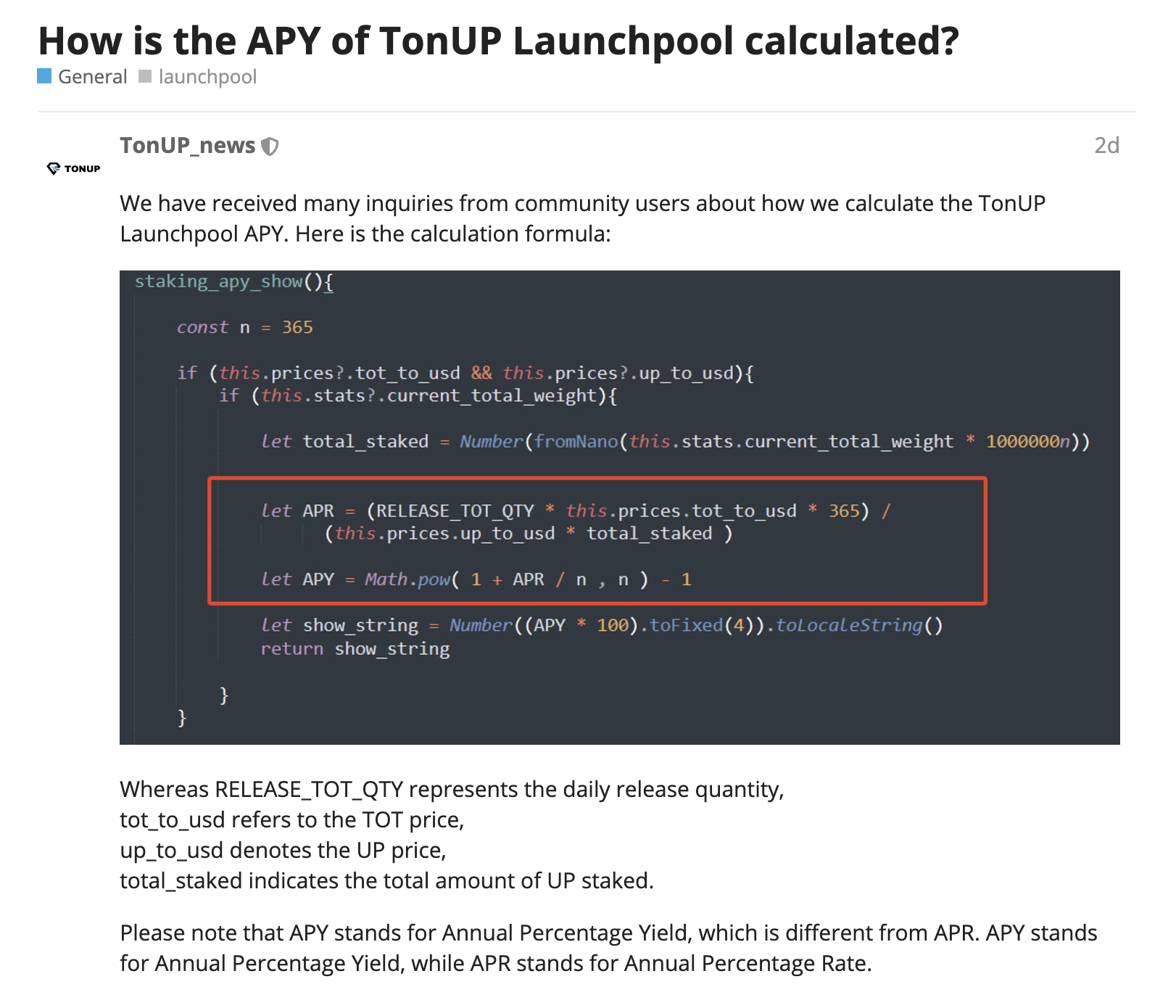

Let's take TonUP Launchpool as an example, the official website has both Staking APR and Staking APY labeled, and the difference between these two numbers is almost 4 times. The reason for this is that APY is actually a weighting of APR. TonUP has disclosed their APY and APR calculation method in one of their community articles, and we can see the difference by following this algorithm.

In this formula, APR is calculated as APR = (RELEASE_TOT_QTY * TOT_TO_USD * 365) / (TOT_TO_USD * TOTAL_STAKED), i.e., the theoretical number of annual outputs divided by the total number of pledged $UPs taken by the user. APY's formula, on the other hand, is weighted on a sub-basis, assuming that the user compounds interest once a day for 365 days (i.e., trades the acquired $TOT for $UP and pledges it again).

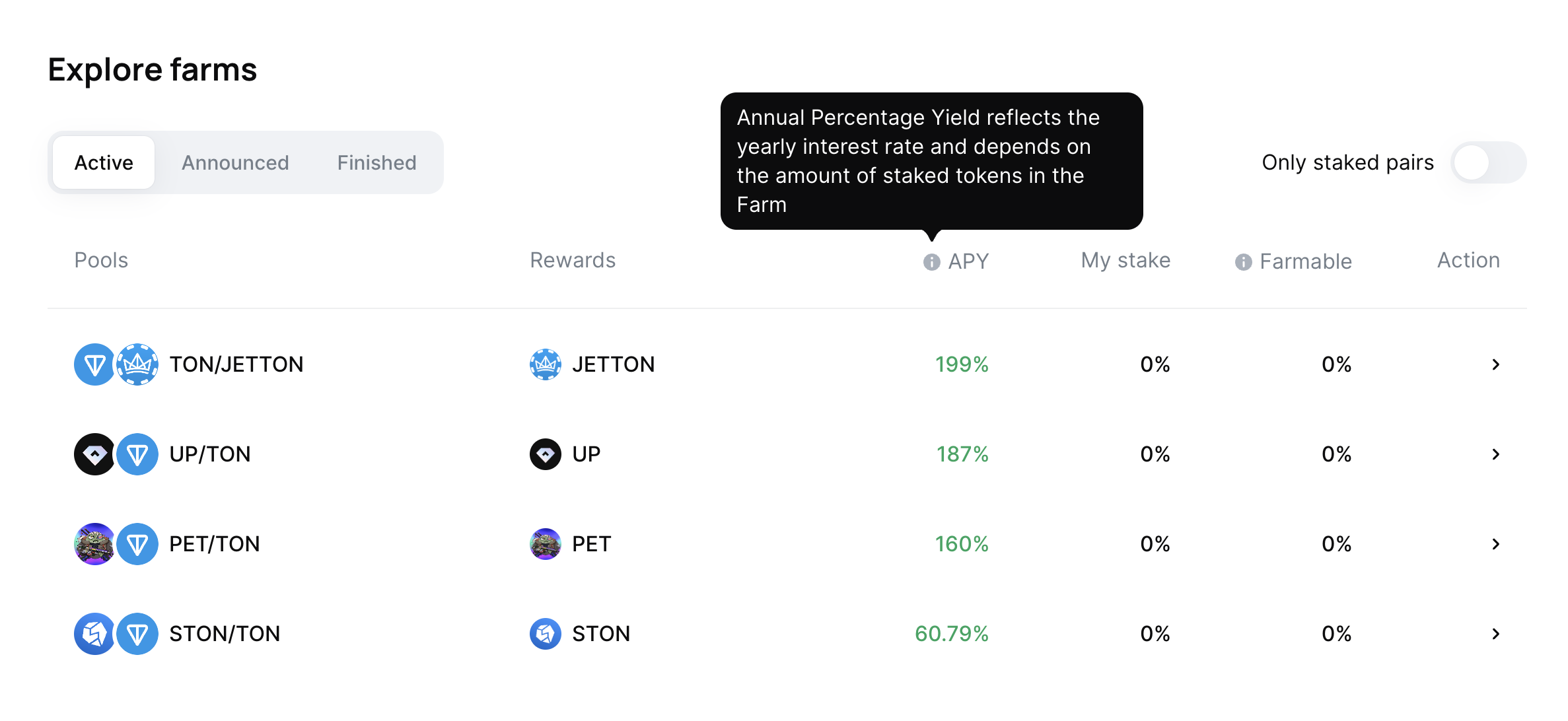

Theoretically, both APY and APR are calculated in a way that is consistent with industry norms, but using APR is indeed a tricky approach. However, we would like to point out that although the use of APY is common in the industry, for example, STON.fi uses APY to label mining and LP returns. Still, DetectiveTON recommend that projects adopt a model like TonUP & DeDust, where both APR and APY are labeled and the exact calculation is made public.